China is the world’s largest producer and consumer of hydrogen. Most of this hydrogen is used as a chemical feedstock. Almost all hydrogen in China today is made from coal or natural gas, releasing carbon dioxide (CO2) to the atmosphere in the process.1

In March 2022, the Chinese government published its first plan for long-term development of the hydrogen industry. The plan calls for greater use of hydrogen fuels and more production of low-carbon hydrogen.2 More use of hydrogen fuels in China will increase CO2 emissions unless the hydrogen comes from low-carbon sources.

Background

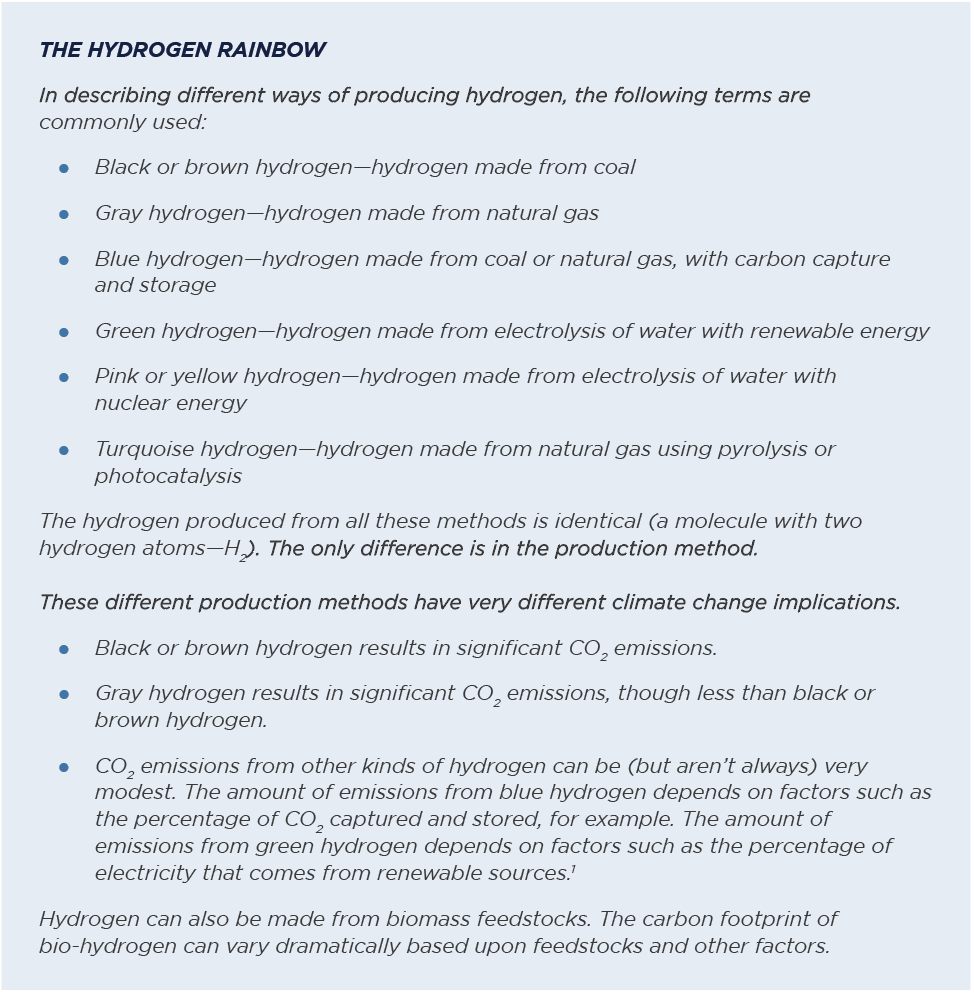

Hydrogen is the most abundant element in the universe. However, with rare exceptions, hydrogen occurs in nature only when bound with other elements into molecules such as CH4 (methane) or H20 (water). The process of separating hydrogen from those molecules can result in substantial CO2 emissions (such as when hydrogen is stripped from coal or natural gas). The process of separating hydrogen can also result in almost no CO2 emissions (such as when hydrogen is released from water using electricity made with renewable or nuclear power).3

Hydrogen is not a heat-trapping gas. As a result, hydrogen can play an important role in helping fight climate change.

- Hydrogen burns at high temperatures, which makes it potentially valuable as a replacement for fossil fuels in industrial processes that require high-grade heat (such as in the iron and steel, cement and chemical sectors).4

- Hydrogen can serve as a fuel or as a feedstock for low-carbon fuels.

- Hydrogen can store energy from electricity over long periods, helping tackle issues related to variable wind and solar power.

Yet even though hydrogen is not a heat-trapping gas, it has climate change impacts. First, the process of producing hydrogen can and usually does result in CO2 emissions. Second, when hydrogen is released into the atmosphere, it contributes to the formation of methane and other heat-trapping gases and lengthens the residence time of those heat-trapping gases in the atmosphere.5

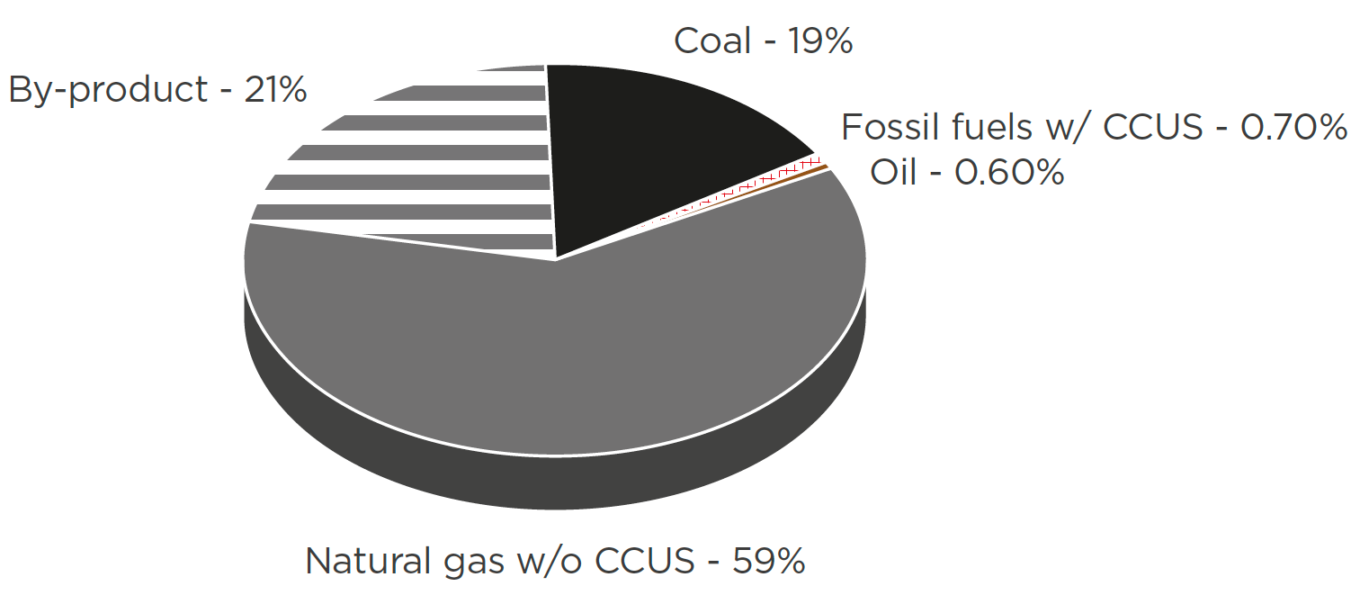

Figure 13-1: Energy Sources for Hydrogen Production Worldwide

Source: IEA. Global Hydrogen Review 2021, (October 2021)6

7Above as 1

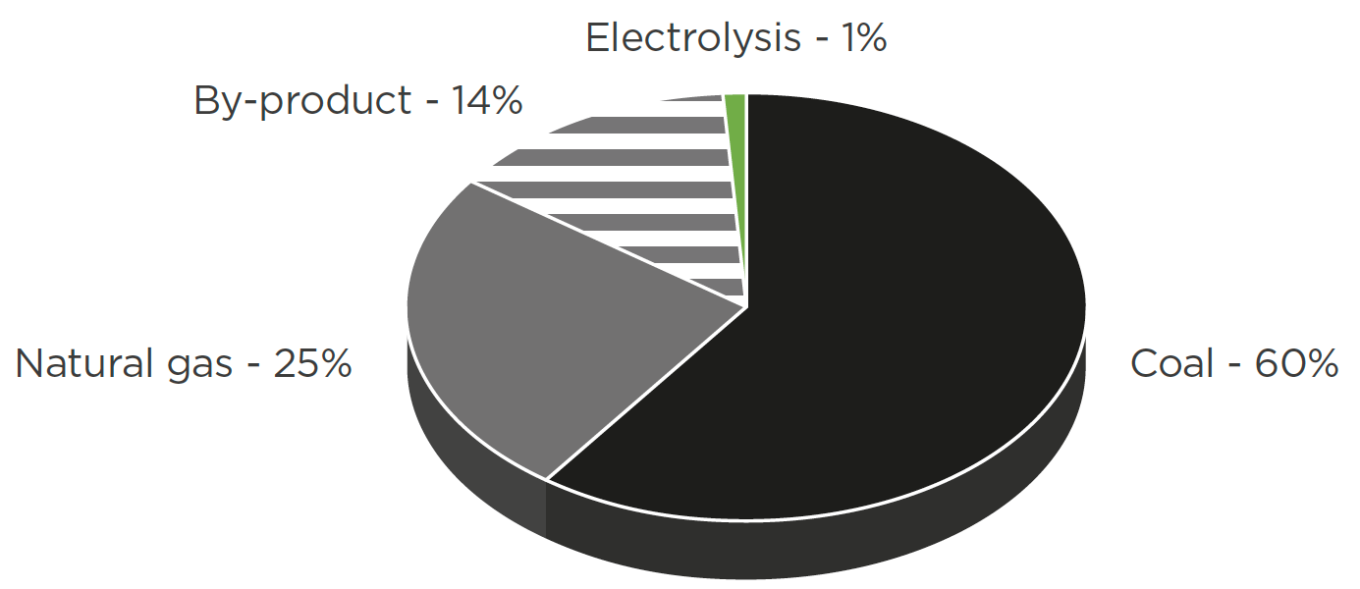

China is the world’s largest producer of hydrogen, with an annual output estimated at 33 million tonnes (Mt).8 Black or brown hydrogen (from coal gasification) predominates, unlike in most other countries where gray hydrogen (from steam reformation of methane) is most common. Roughly 60% of China’s hydrogen comes from coal and 25% comes from methane. Most of the remaining hydrogen is a byproduct of petrochemical industry processes. A very small percentage of China’s hydrogen comes from electrolysis.9

Figure 13-2: Energy Sources for Hydrogen Production in China

Source: CSIS (February 2022); NDRC (March 2022)10

In China, hydrogen is used principally for ammonia synthesis, methanol production and petroleum refining. (In 2020, 11 Mt of hydrogen was used for ammonia synthesis, 9 Mt for methanol production and 8 Mt for petroleum refining.) Hydrogen is also used in metal smelting, electronics, pharmaceuticals and other sectors.11

According to the IEA, the use of hydrogen-based fuels could avoid cumulative emissions of close to 16 Gt CO2 in China by 2060, with the biggest reductions coming from industry, followed by shipping, aviation and road transport.12 However for hydrogen to help mitigate climate change and contribute to decarbonization, it must be produced with low-carbon processes and leaks must be controlled.

Policies

Historical policies

Chinese hydrogen policies date to the 10th Five-Year Plan (2001–2005), which included attention to hydrogen in the transport sector. Hydrogen fuels were seen as a potential way of reducing China’s growing oil import dependence—a source of significant strategy vulnerability due to China’s rapidly growing vehicle fleet. Hydrogen fuels were also seen as potentially helpful in curbing urban air pollution.13

In 2015, the Chinese government published the Made in China 2025 initiative—a ten-year plan to upgrade China’s manufacturing industry—citing hydrogen as a key technology to develop in the energy vehicle market.14 The following year, the first Hydrogen Fuel Cell Vehicle (FCV) Technology Roadmap was released aiming for mass application of hydrogen in the transport sector by 2030.15

The Hydrogen FCV Roadmap included interim targets to have 5,000 FCVs in demonstration, alongside 100 hydrogen refueling stations by 2020, focusing on industrial clusters and demonstration-application areas in the Beijing–Tianjin–Hebei area, as well as the country’s manufacturing and export powerhouses in the Yangtze River Delta, Pearl River Delta, Shandong Peninsula and the central region.16 At the end of 2021, 10,700 FCVs (mostly buses and trucks) were deployed in China, with 194 hydrogen fueling stations in operation.17

The Hydrogen FCV Roadmap also envisioned having over 50,000 FCVs and more than 300 hydrogen refueling stations in operation in 2025, and over over 1 million FCVs by 2030 and more than 1000 stations by 2030.

Similarly, the National Innovation-Driven Development Strategy and Action Plan for Innovation in the Energy Technology Revolution (2016–2030)18 list hydrogen and fuel cell technology as central components of China’s future energy system. The 13th Five-Year Plan for Strategic Development in Emerging Industries19 suggests systematically encouraging research and industrial development in the FCV area and promoting hydrogen storage systems.20

The National Alliance of Hydrogen and Fuel Cells (or China Hydrogen Alliance) was launched in 2018. In an April 2021 report, the Alliance predicted that hydrogen production from renewable energy in China would reach 100 Mt by 2060, with total hydrogen use reaching 130 Mt and accounting for 20% of China’s final energy consumption. According to the Alliance, around 60% of hydrogen demand will come from industry, with most of the rest coming from transport.21

The transport sector has remained a focal point for government hydrogen policy. In 2020, China’s Ministry of Finance (MOF), Ministry of Industry and Information Technology (MIIT), Ministry of Science and Technology (MOST), and National Development and Reform Commission (NDRC) jointly released A Notice on Optimizing Fiscal Subsidies for Promoting New Energy Vehicles22 as part of the government’s annual review of subsidy policies. In the Notice, “new energy vehicles” refer to battery electric vehicles, plug-in hybrid vehicles and fuel cell vehicles (FCVs). The 2020 Notice set out measures to replace vehicle purchase subsidies with a four-year pilot program in which cities were selected to carry out research, development and demonstrations of FCVs. The scheme rewards clusters of cities based on a series of parameters, including the deployment of more than 1000 FCVs that meet certain technical standards, achieving a delivered hydrogen price at a maximum of RMB 35.00/kg ($ 5.00/kg) and providing at least 15 operational HRSs.

The base subsidy for fuel cell electric passenger cars is a linear function of the rated power of the fuel cell system (RMB 4,800/kW) and capped at RMB 160,000 per car. For light-duty fuel cell electric commercial vehicles—i.e. buses, coaches, trucks and vocational vehicles—the base subsidy is RMB 240,000 per vehicle. For medium to heavy-duty commercial vehicles, the base subsidy is RMB 400,000 per vehicle.

In 2020, the four ministries further issued A Notice on Launching Demonstration Applications of Fuel Cell Vehicles23 offering additional details on the four-year subsidy program for FCVs which aims to support the entire value chain from vehicle production and infrastructure development. Cities can apply to be included in the pilot program with funding attributed according to a point system.24 Following the Notice, several provincial governments issued their own subsidy programs,25 in addition to central government support.

In 2020, China accounted for 8% of the global stock of electrolyzers and 35% of the global manufacturing capacity of electrolyzer equipment and components.26 The China Hydrogen Alliance estimates China could add 100 GW of electrolyzer capacity by 2030 to produce green hydrogen.27

Current policies

In March 2022, NDRC published its Medium- and Long-Term Plan for the Development of the Hydrogen Energy Industry (2021–2035)28—the first official document to lay out a long-term vision for China’s hydrogen economy. The Plan consolidates hydrogen policy initiatives into a single document and reiterates some goals set out in previous plans, including the deployment of 50,000 fuel cell vehicles by 2025.29

NDRC’s Hydrogen Plan emphasizes that provinces should choose their hydrogen production routes according to local conditions (including resource endowments and industrial structure), giving them considerable leeway in hydrogen production. This could promote innovation, as the provinces experiment with different approaches for scaling up hydrogen infrastructure. It could also lead to overcapacity, as provinces build production capacity independently.

NDRC’s Hydrogen Plan calls for establishing hydrogen markets close to current production sites, including where hydrogen is recovered as an industrial byproduct from alkaline production, propane dehydrogenation (PDH) plants and renewable electrolysis power-to-gas. The Plan also calls on the industry to pilot more advanced technologies including seawater electrolysis, nuclear hydrogen production and others. The Plan reiterates the importance of hydrogen fuels for transport in the near term but emphasizes that, going forward, hydrogen application needs to be developed in energy storage, power generation, industry and other sectors.

NDRC’s Hydrogen Plan also calls for production of 100,000–200,000 tonnes of green hydrogen per year by 2025 (roughly 0.3% to 0.6% of current hydrogen production). According to NDRC, this will lead to CO2 emissions reductions of 1–2 Mt per year by 2025. These targets are widely seen as easily achievable. By 2035, Beijing is aiming for a complete and diversified ecosystem of green hydrogen applications, covering transportation, energy storage and industry.

The Plan is informed by a number of earlier policy documents:

- In March 2020, the National Development and Reform Commission and the Ministry of Justice issued Opinions on Accelerating the Establishment of Green Production and Consumption Laws and Policies,30 stating that the promotion of clean energy development requires the study and formulation of standards and supporting policies for new technologies, such as hydrogen and ocean energy.

- The draft Energy Law, issued in April 2020, re-classified hydrogen as a secondary energy source, rather than a hazardous material. When regarded as a hazardous material, its production, transportation, refueling and storage has been strictly regulated, entailing lengthy approval processes. For example, production is restricted to chemical industry zones, hindering the development of on-site HRS. In road transport, the working pressure of tube trailers for hydrogen transportation is limited, resulting in low transportation efficiency and high costs.31 At the time of writing, the draft Energy Law has yet to be finalized, and so hydrogen remains a hazardous material.

- In 2020 and 2021, several policy documents were released outlining technical requirements for hydrogen pipelines, storage systems and refueling stations. The documents included guidance for universities and other educational institutions,32 stressing the need for research on the hydrogen economy, including on fuel cells, and hydrogen storage.33

- The State Council’s White Paper on China’s Energy Development in the New Era,34 published in December 2020, includes a broad ambition to develop green hydrogen production, storage, transportation and application, and promote the development of the hydrogen energy fuel cell technology chain and hydrogen fuel cell vehicle industry chain.

- The National Development and Reform Commission’s Catalogue of Encouraged Industries in the Western Region, issued in January 2021, includes hydrogen processing and manufacturing, hydrogen energy fuel cell manufacturing, hydrogen transmission pipeline and hydrogenation station construction.35

- The State Council’s Guiding Opinions on Accelerating the Establishment and Improvement of the Green and Low-carbon Circular Development Economic Systems36 discusses the need to promote the green and low-carbon transformation of the energy system and to develop hydrogen energy.

- In March 2021, the 14th Five-Year Plan for National Economic and Social Development and the Long-Range Objectives Through the Year 2035 for the People’s Republic of China,37 also identified hydrogen as one of the six industries that China should focus on.

- The 14th Five-Year Plan for a Modern Energy System,38 issued in March 2022, reiterates the importance of hydrogen production, innovation and deployment.

All these documents include discussions of hydrogen, highlighting the growing importance of hydrogen both as an industry and a low-carbon solution for China’s decarbonization plans, they offer few concrete targets and details.

In addition to the central government level guidance, 28 provinces have included the development of hydrogen energy in their provincial 14th Five-Year Plan for National Economic and Social Development and the Outline of Long-Term Goals for 2035. Ten provinces, including Guangdong and Shanxi, have included development of hydrogen energy in their Government Work Reports in recent years. Shandong, Hebei and Zhejiang have released development plans for their hydrogen energy industries. Many other provinces have adopted policies to promote hydrogen energy, including policies related to the construction of hydrogen energy infrastructure and the manufacturing of key components.39

Climate Change Implications

The relationship between the Chinese government’s hydrogen policies and its climate goals is unclear. Today, almost all hydrogen in China is made from fossil fuels, releasing heat-trapping gases into the atmosphere in the process. The expansion of this industry as called for in central government planning documents could significantly increase emissions. The planning documents also call for increased production of low-carbon hydrogen, but in small amounts. If demand for hydrogen grows faster than the supply of low-carbon hydrogen, that would increase CO2 emissions, making it more difficult to achieve China’s carbon peaking and carbon neutrality goals.

References